Not all accounts are worth your time, and chasing the wrong ones is a huge drain on resources. That’s where account scoring comes in. It helps you prioritize the best opportunities based on real data, not guesswork.

But for scoring to actually be useful, it needs to be built on accurate, up-to-date information.

Otherwise, you’re just adding another layer of noise. This article breaks down how to automate account scoring using the right data signals, tools, and workflows. This helps you focus on the accounts that are most likely to convert.

Why Data Quality Matters in Account Scoring

Clean, accurate data is essential for building an effective account scoring model. Without it, teams are forced to spend excessive time on manual research or worse, target the wrong accounts.

With advancements in AI and intent signals, leveraging data to generate pipeline is now more efficient than ever.

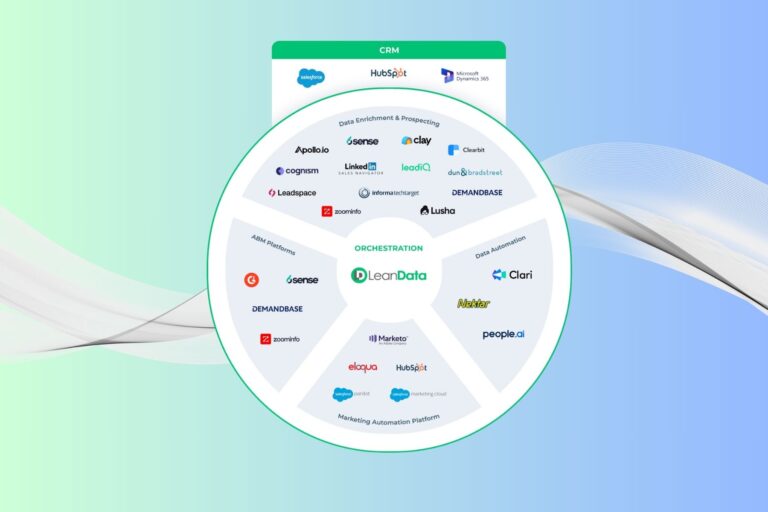

Signals and data points tend to be categorized by firmographic data vs. intent data:

Firmographic Data

Static attributes that define a company, such as industry, company type, and employee count. These characteristics change infrequently.

Intent Data

Behavioral signals that indicate a company’s interest or readiness to buy, based on actions taken by employees (i.e., website visits, content downloads, intent, job changes). These signals are more dynamic and can change frequently.

Determining the strength of a signal requires a customer health and churn analysis to weigh the impact of different data points.

For example, a company receiving funding or growing headcount in specific departments may be a stronger indicator of potential interest than a company simply meeting employee size criteria.

A thorough customer analysis involves digging into a variety of the data points listed below. Additionally, factors such as product utilization, size of contract, number of service tickets submitted, and potential churn risk provide deeper insights.

To maintain efficiency when building an account scoring model, data and signals should guide us towards healthy customers, not just any customer.

Key Signals & Data Points for Account Scoring

How to Capture and Use Signals & Data

Automating account scoring starts with the right data, but not all data is created equal. Some signals are easy to collect, while others require deeper tracking and validation.

The key is using a mix of tools to ensure accuracy and completeness. To achieve this, here’s a breakdown of the best ways to gather and leverage account data effectively.

Tools for Automated Account Scoring

- Enrichment Platforms: Provide firmographic and technographic data. Think Clearbit, Cognism, Bombora, Clay

- ABM Platforms: Track intent signals and buying behavior. Think 6sense, Demandbase, RollWorks

- Contact Acquisition Platforms: Identify and track decision-makers. Think ZoomInfo, LeadIQ, Cognism, Apollo

- Agencies or Contractors: Useful for specialized data sourcing or verification.

- Manual Research by Sales Reps: Can be used for real-time validation or deeper account insights.

Using multiple sources ensures accuracy and comprehensive coverage.

Cost Considerations for Automated Data Collection

The difficulty and cost of data collection will vary based on the type of data and the tools used.

- Easiest to collect: Enrichment, ABM, and contact acquisition platforms provide automated updates (daily, weekly, or monthly), making data collection seamless.

- Cost considerations:

- Enrichment platforms typically charge per record enriched.

- ABM platforms are often priced based on features and platform tiers.

- Contact acquisition tools may charge per contact retrieved or via subscription models.

Therefore, cost should be evaluated based on the data volume needs and required data depth.

Keeping Account Scoring Data Clean & Accurate

To ensure long-term success, maintaining accurate data requires a combination of automation, governance, and periodic reviews.

Here are some best practices:

- Automate data enrichment: Ensure your tech tools continuously update CRM records, with all field mappings being set up accurately.

- Standardize data entry: Establish clear data entry rules to prevent inconsistencies.

- Set up deduplication rules: Prevent duplicate records through automated merging rules using a tool like LeanData and/or Cloudingo.

- Create a primary source of truth: Align your entire organization around having the CRM be the primary source of truth.

- Track email bounces & job changes: Automatically update contact details when employees switch companies.

- Conduct regular data audits: Identify and correct incomplete, outdated, or misassigned records; archive old data as needed.

- Set up data governance policies: Clearly define ownership and expectations by role.

- Create validation rules: Enforce mandatory fields or logic-based restrictions to prevent bad data entry, but set up only when needed.

- Confirm proper tool integration: Setup bidirectional syncs and avoid overwriting data, troubleshoot errors, and ensure correct data flow across platforms.

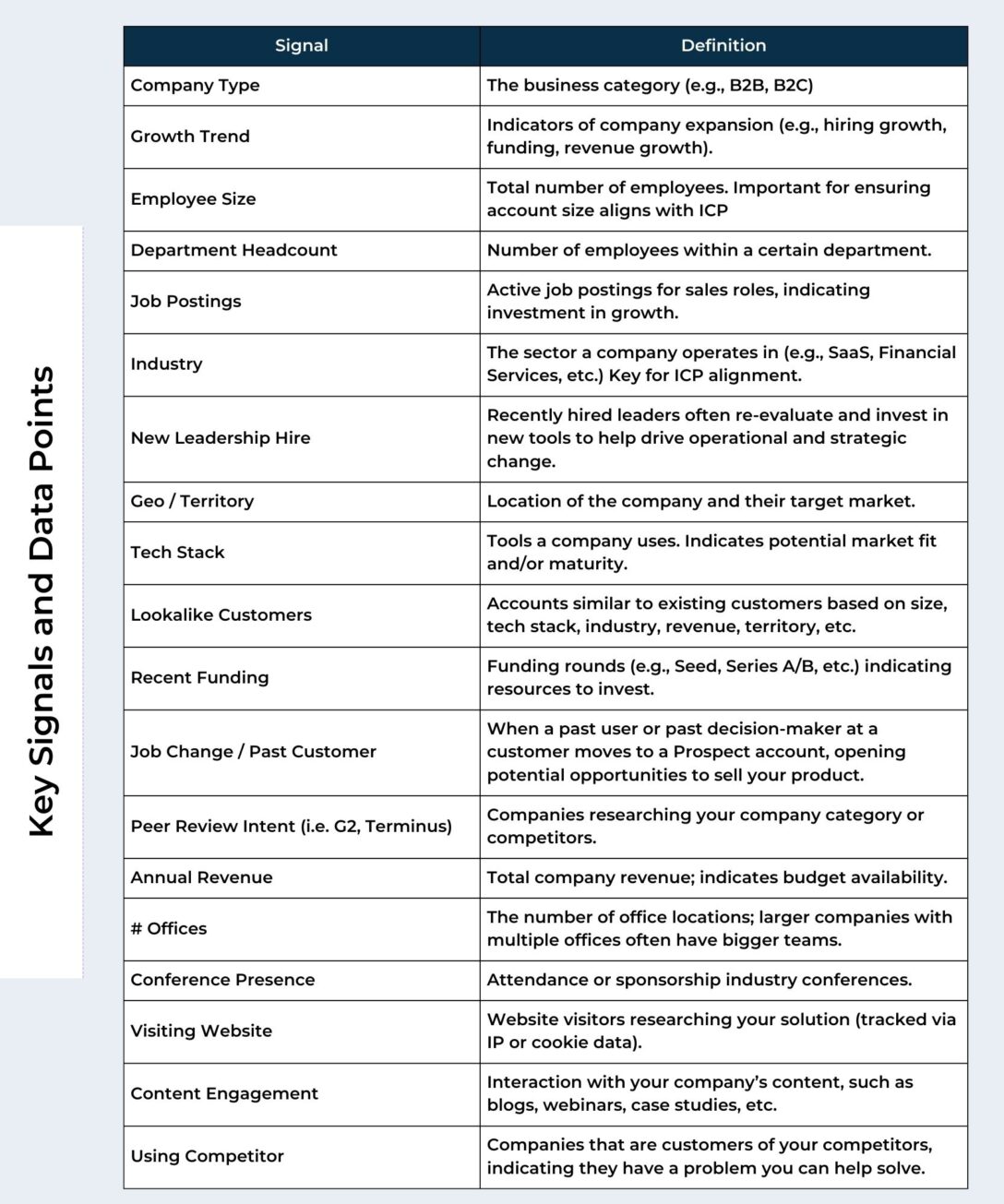

How to Build an Account Scoring Model

After a customer health and churn analysis is completed to determine the level of prioritization and strength of each signal, the next step is to build a scoring model to help reps prioritize the best accounts.

Approach #1: Weighted Model

- Simple and effective

- Good for a straightforward approach

How it Works:

- Assign point values to different data points

- Create a scoring rubric

- Prioritize Accounts above a certain threshold

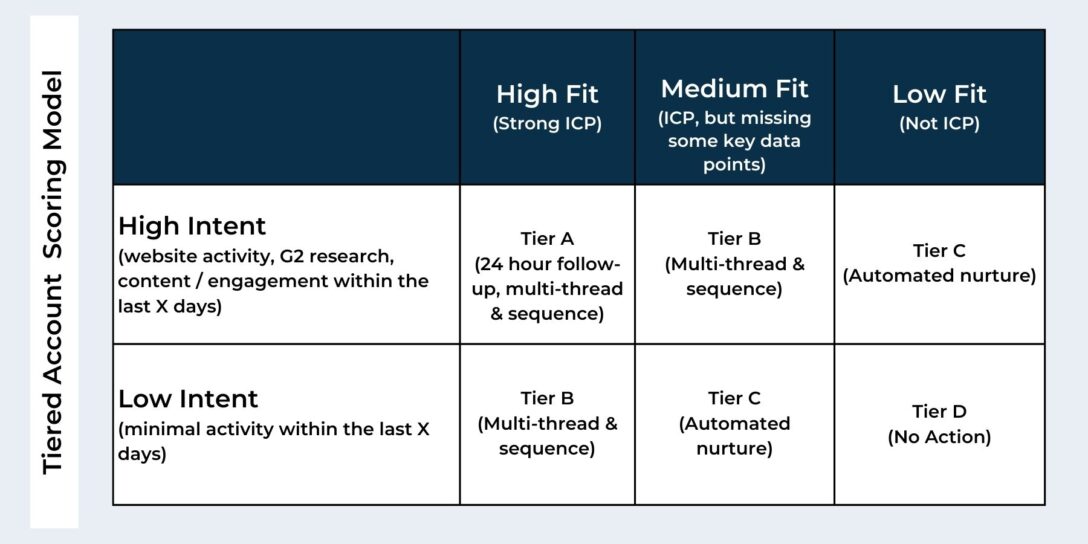

Approach #2: Tiered Model

- More complex

- Helps prioritize action items

- Good for blending firmographic and intent

How it Works:

- Assign accounts into tiers based on fit and intent signals

- Use tiers to qualify accounts and determine action items

Common Pitfalls in Account Scoring

Account scoring can be a game-changer, but only when it’s done right. Unfortunately, plenty of teams make mistakes that lead to wasted effort and missed opportunities.

Here’s what to watch out for:

1. Leaning Too Much on One Type of Data

Some teams focus only on firmographics (industry, size, revenue) and miss high-intent accounts ready to buy. Others chase intent signals (website visits, content downloads) without checking if the company is even a good fit. A strong scoring model blends both—so you’re targeting accounts that are both interested and qualified.

2. Letting Data Go Stale

If your scoring model isn’t updated regularly, you might be chasing companies that no longer fit your ICP or engaging contacts who left months ago. Use automated enrichment tools and set up periodic data reviews to keep your scoring accurate.

3. Guessing at Scoring Weights

Randomly assigning points to different signals without checking real conversion data is risky. If website visits get too much weight, reps might waste time on casual browsers instead of real buyers. Use historical data to fine-tune scoring so it reflects what actually leads to closed deals.

4. Treating It Like a One-and-Done Project

Scoring models need constant tweaking based on what’s working. For instance, if high-scoring accounts aren’t converting, or great opportunities are slipping through, it’s time to adjust. Reviewing the model quarterly keeps it aligned with real buying behavior.

5. Sales and Marketing Playing by Different Rules

If marketing is handing off leads based on engagement, but sales only cares about firmographics, you’ll end up with frustration on both sides. Make sure both teams agree on what “qualified” looks like and refine the model together.

Avoid these pitfalls, and your account scoring model will actually do what it’s supposed to—help your team focus on the best accounts at the right time.

How Scoring Models Influence Outreach Strategies

The entire goal of an automated account scoring model is to help sales and marketing teams focus on the right accounts at the right time.

So, once your scoring model is in place, here’s what you actually do with the scores:

High-scoring Accounts

High-scoring accounts have strong intent signals (recent funding, leadership changes, using a competitor) should be prioritized for immediate outreach. Assign them to senior reps, and engage with personalized messaging. These accounts may also be fast-tracked through the sales cycle.

Mid-tier Accounts

Mid-tier accounts show moderate intent but lack urgency. These accounts benefit from nurture campaigns such as targeted emails, periodic SDR check-ins, and automated workflows that monitor engagement. When these accounts show stronger buying signals, sales teams can re-prioritize them.

Low-scoring Accounts

Low-scoring accounts should be placed in passive engagement programs like self-service content or retargeting campaigns. If their signals improve (e.g., website visits, hiring trends), they can be dynamically reassigned for active outreach.

Aligning sales and marketing around score-based segmentation ensures reps receive the most relevant leads, outreach is better timed, and overall conversion rates improve.

Using Account Scoring to Automate Plays in LeanData

Once your account scoring model is set, the next step is putting it to work. LeanData automates this by routing high-scoring accounts to the right reps, triggering sales plays, and ensuring no valuable buying signals slip through the cracks.

Smart Routing Based on Score

LeanData’s FlowBuilder has the power to automatically assign accounts based on their score. For example:

- High-scoring accounts are routed to AEs for immediate outreach.

- Mid-tier accounts go to SDRs for further qualification.

- Low-scoring accounts enter nurture campaigns until intent increases.

To make this seamless, routing triggers, and round-robin distribution ensure accounts are assigned efficiently without manual intervention.

Triggering Sales Plays on Autopilot

LeanData integrates with sales engagement tools like Outreach and Salesloft, so when an account reaches a high score, it can:

- Enroll in priority sales sequences

- Trigger personalized outreach based on high-intent engagement signals

- Auto-create follow-up tasks to keep sales teams proactive

Re-Routing as Scores Change

Account activity changes over time, and LeanData dynamically adjusts workflows:

- If a score increases, the account is routed to sales for immediate engagement.

- If engagement drops, the account moves into a nurture sequence or gets reassigned.

- If an account remains inactive, leadership is alerted or strategies are adjusted.

With LeanData, account scoring becomes more than just a number. It drives real-time sales actions, helping teams focus on the best opportunities at the right time.

Turning Account Scoring into Your Secret Weapon

Account scoring isn’t just about assigning numbers to prospects. Rather, it’s about giving your sales and marketing teams a superpower: knowing exactly where to focus their time and energy. When done right, it removes the guesswork and ensures you’re always engaging with the right accounts at the right moment.

By leveraging high-quality data, automating scoring processes, and integrating tools like LeanData, you can transform account scoring from a static exercise into a dynamic, revenue-generating engine.

Whether you’re identifying high-intent buyers, triggering automated sales plays, or fine-tuning your model over time, the impact is clear. As a result, you’ll achieve better targeting, faster sales cycles, and more wins.

So, go forth and score smarter! With the right approach, you’ll never waste another minute on the wrong accounts again.