Why you should consider a Buying Group approach

Before explaining TechTarget’s operational pilot into Buying Groups and intent signals, it’s important to address why I think companies should consider this approach at all.

Here’s the short answer:

A Buying Group go-to-market motion makes your revenue waterfall much more productive. It sets you up to close more Opportunities for more revenue with the same amount of sales and marketing effort.

In fact, the Forrester early-adopter evidence to date shows many companies already experiencing these results.

Who wouldn’t want more growth for their business?

Three paths to greater revenue

At TechTarget, we’ve found when you combine the Buying Group approach with strong data sources, you can get to more revenue in three very specific ways:

- You’ll close more of the Opportunities in your pipeline. Greater visibility helps you focus better and do the work required to progress Opportunities more effectively.

- You’ll create more Opportunities in target Accounts. You can now see Contacts in your target Accounts more clearly and are thus more inclined to allocate the resources needed to capitalize on those Accounts.

- You’ll see, recognize, and effectively capture Opportunities you would otherwise have missed completely.

Given how good Forrester’s numbers on this are, I think they’d make any CRO/CEO perk up and pay attention.

10%-20%

5%-15%

Source: Don’t Let Culture Eat Revenue: Building an Intent-Driven Revenue Engine

So assuming you too are intrigued about this more logical and comprehensive approach, I wanted to share some of the thinking and steps we’re using at TechTarget to implement a Buying Groups approach for ourselves.

(Note: The approach assumes a business focus on large, complex deals with long sales cycles and multi-person Buying Groups).

First things first: Marketing change management

As you prepare to launch your own Buying Groups-focused change effort, you’ll want to set the stage properly for your various constituencies.

Reflect for a moment on these three essential points:

(Note: if you skimp on any of these, it will go a lot harder for you!)

Sales willingness

As marketers, we have a lot more process leeway than we realize, but we need to seize the reins on this. In reality (within reasonable parameters), sales only cares that we are truly helping them. They really don’t care how we do it.

Still, you need to get clear buy-in from − and the executive support of − sales leadership. Things go much more smoothly when you do. Skip this step and sales could easily end up blocking your program. It may be because they just don’t understand, or simply because you didn’t politely consult them first.

Systemic and cultural marketing barriers

Part of what stands in the way here is our own love of the MQL. It seems simple and clear. We know how to deliver it. But, to start connecting the process dots, you’ll need to refocus your objectives, past Leads and onto Opportunity creation and Closed-won success.

(If this messes up your current compensation model, it’s time to change that too.)

Sales development collaboration

Because process changes can cause breakage that undermines effort, you need to work very closely with the people whose job it is to qualify Leads and create Opportunities in your CRM.

If you don’t, there’s no way to ensure that what you think should be better for them really will be. Since you’ll be asking them to evolve their way of working, you need to make sure they are fully on board and enabled to do so.

Does this really signal the end of MQLs?

I think the whole “death of MQLs” brouhaha was caused by true believers who were trying to drum up Buying-Group interest from busy demand gen practitioners. It worked, but has caused some un-useful misunderstandings.

For TechTarget, the answer to this question is an unequivocal “No.”

Here’s why:

- MQLs are a critical signal of a specific person’s (and therefore their company’s) awareness of you and willingness to consume information from you.

- The MQL signal is a useful measure of your marketing’s penetration into ICP accounts and engagement with the right people there. It’s great for evaluating the attractiveness of your content and the effectiveness of your content distribution strategy.

- In order to craft better talking points, it’s extremely helpful for Sales to know exactly what content from you has piqued a prospect’s interest, (at a minimum) as a conversation starter.

All that said, we do recognize and agree that MQLs and MQL-based processes have drawbacks, but we don’t need to go into that here. We’ve discussed and highlighted these at length in a variety of webinars and e-books.

Designing your pilot: Start with a workable output definition

As systems-oriented players, most of you have probably experienced being a member of a Buying Group yourselves. So you are likely to understand the concept as well as anyone right out of the gate.

But, just as with “Leads” for proper lead management and “Opportunities” for pipeline management, to operationalize a thing like Buying Groups, you need to be working with a very clear definition that everyone affected can agree on.

Helpfully, in our own early discovery process, we uncovered two very useful facts about our seller processes that we could build on:

Tapping into existing momentum within the SDR team

Among our outbound SDR team, while they didn’t use the term “Buying Group,” they were applying a similar concept in their workflow. Once we saw that, we knew better how we should position our project to them. We could build on their existing understanding and momentum.

Mirroring best practices from best sales reps

Very good account executives were already using the Salesforce Opportunity Contact Record (OCR) to capture and track multiple members of the Buying Group. We knew that our sales teams often discussed and trained on the importance of “multi-threading” their deals.

However, when inspecting Opportunities manually, it seemed most sellers typically included only one Contact.

It was when we zeroed in closer on some of our very best reps (and their more complicated deals) that we found the evidence we needed. They too were already leveraging both the Buying Group concept and some of the necessary system functionality of their own accord.

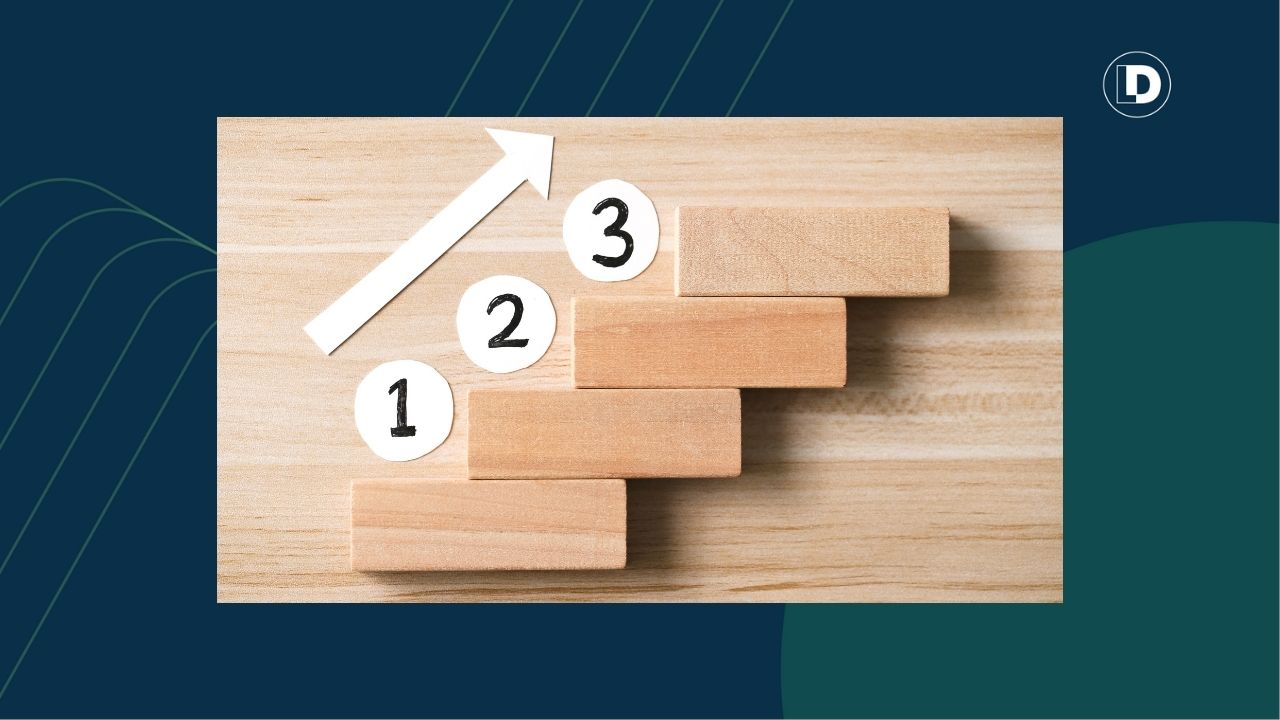

Pilot Step 1: Objectives and definitions

Getting to a usable Buying Group “minimum criteria” and target output

Although we share the same goals at a high level, to operationalize Buying Groups in our systems, we couldn’t use the same approach as our SDR were using for cold outreach. Their definition needed to deliver a large enough group of people to maximize their chances of successfully engaging anyone.

Working from the hypothesis that Buying Groups should help SDRs deliver more opportunities using the same amount of total resource, we needed our SDRs to:

- Prioritize Buying Groups over cold outreach and single MQLs alike.

- In the presence of an identified Buying Group, work the Account more than they might for a single MQL. Specifically, if they failed with one person, they were to continue working the others rather than discounting them as well.

- Create meetings that included multiple Buying Group members – essentially doing more multi-threading on behalf of the account executive sellers.

Our Buying Group minimum definition

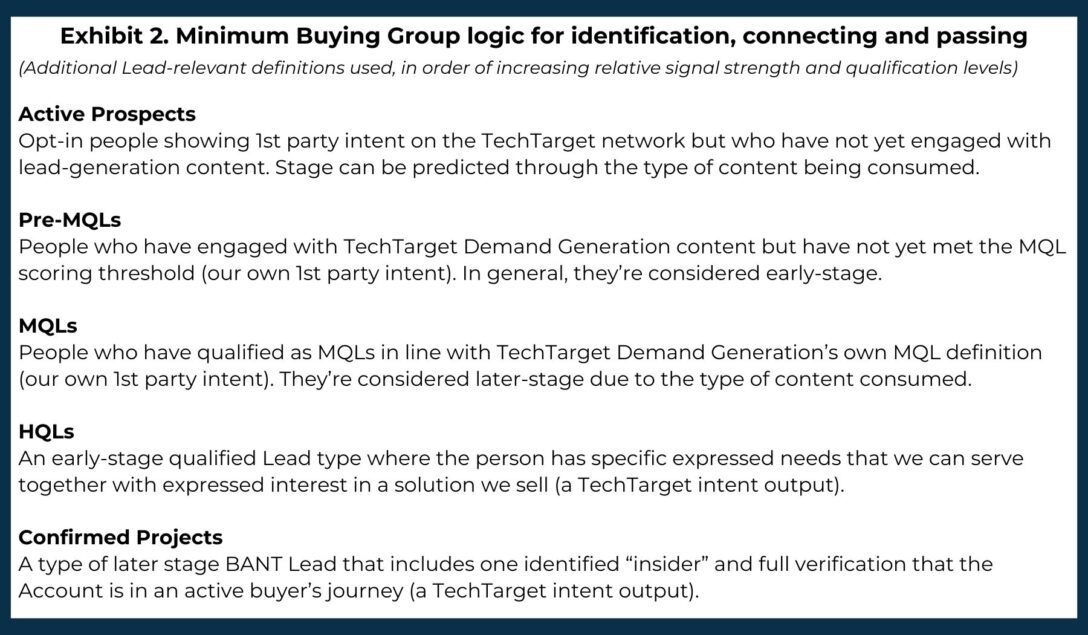

Based on our working hypothesis and the business objectives for our pilot, we agreed that the minimum definition for marketing to create and pass a Buying Group to an SDR consisted of:

- Two people from the right account firmographics.

- Both with the right role and function demographics.

- Both of whom were shown to be actively interested in the same solution area or topic.

- And most importantly, who were showing intent signals at an intensity level that should inspire SDR action.

From there, we then moved on to design and build out our solution to deliver a new type of Lead package. It would be, at minimum, equal to (and probably better than) either targeted cold Account outreach or single MQLs.

Pilot Step 2: Building our MVP

A testable solution for comparing our minimum Buying Group definition to a single MQL

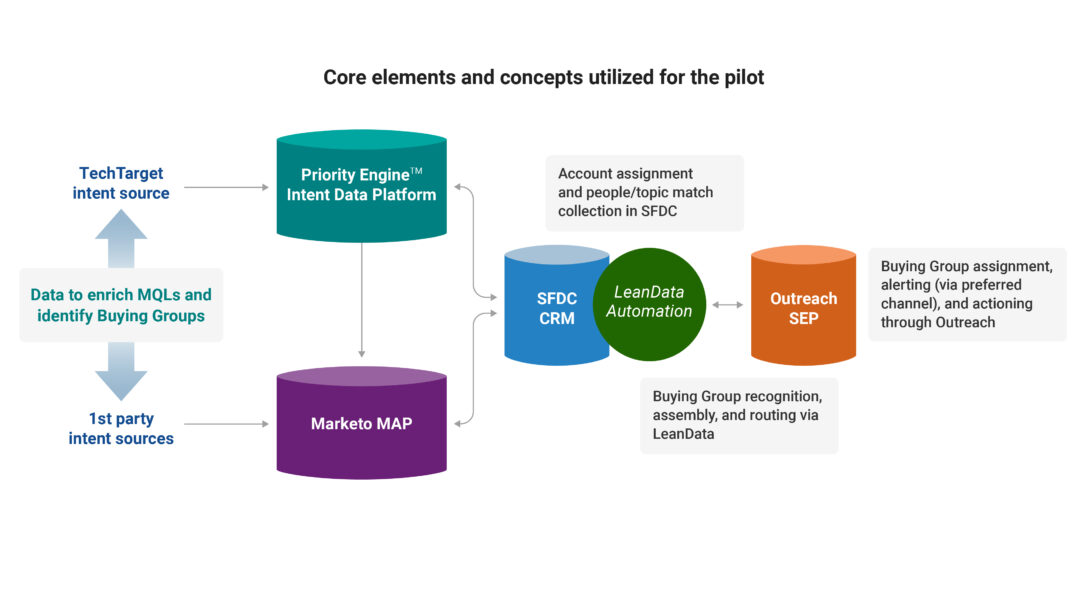

The build-out of our minimum viable product (MVP) as a testable solution depended on six essential components within our stack:

- Integrated opt-in person-level intent data flows from TechTarget Priority Engine, the source of “Active Prospects”, HQLs and Confirmed Projects noted above.

- Marketo: for our own 1st party pre-MQLs and MQLs noted above.

- Salesforce CRM and its Opportunity Contact Record where we incorporated new functionality to manage the de-duplication of Opportunities and the transfer of names from a discontinued OCR to a pre-existing one on an already-existing Opportunity, on the same topic, and involving at least one of the same people.

- LeanData for routing and related automations (out-of-the-box and custom, built with the LeanData team) including grouping and lead types and keeping them together throughout the process.

- Outreach.io as our SDRs’ primary workplace.

- Shared project ownership between MOPs and a fully bought-in SOPs team.

Pilot Step 3: Reviewing our solution with Sales Enablement & SDR management

All along the way in devising and building our solution, we made sure to consult with SDR management, namely because SDRs would be the target users. Similarly, we stayed in continuous contact with the head of Sales Enablement. In our organization, they are the gatekeepers for any process or content changes that could impact seller activity.

When we were ready to launch into production and live in-market, we carefully prepared a refinement of our original pitch.

Our final pre-launch pitch focused on getting renewed approval from affected leadership. We needed their support to test the theory that by adding our new Buying Groups to the prospecting motions of SDRs, we could increase opportunity volumes (and we expected, closed-won revenue) as compared to either MQLs or cold outreach alone.

The pitch was accepted. We got our approval.

So now, in collaboration with LeanData, we are doing in-market testing with a Buying Group solution pilot that enriches our Leads with TechTarget Active Prospects (known people showing intent) as a new and better path to healthier, more productive pipelines.

A working Phase 1 MVP Buying Group solution in brief

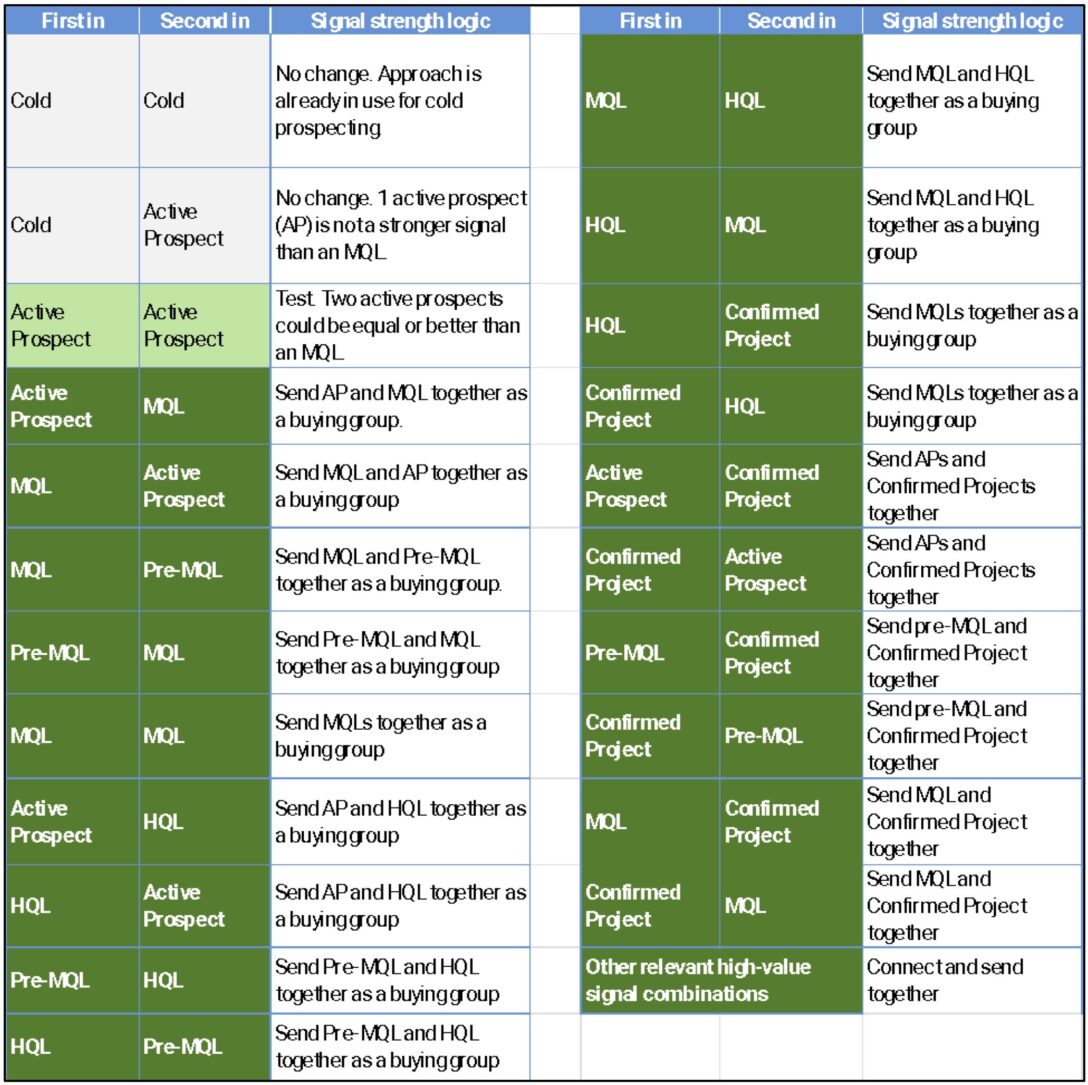

With a minimum acceptable Buying Group definition in place, we built out a list of all the necessary conditions that met our criteria and selected a subset to pilot with.

We used the following conditions to trigger the creation of new Buying Groups in our stack, specifically:

- We connect two (or more) people together as a new Buying Group.

- We create a pre-pipeline Opportunity and populate the OCR with these people.

- We alert the appropriate SDR to the creation of the group

- And we simultaneously pass to them a pre-pipeline Opportunity package including “next steps” instructions on how to check for duplicates and take appropriate action.

Here at TechTarget, we’re super excited about the early outcomes of the work.

Right now, our pilot continues to run and we’re planning further enhancements. If you’d like to discuss your own thinking on these topics, or to talk more about any part of this project, don’t hesitate to reach out to me or an appropriate colleague.

And make sure to join the conversation on LinkedIn at Buying Group Leaders.